Appraisal and Pricing Challenges

First American Title issues a quarterly report, the Real Estate Sentiment Index (RESI), which “measures title agent sentiment on a variety of key market metrics and industry issues”.

Their 2015 4th Quarter Edition revealed some interesting information regarding possible challenges with appraisal values as we head into 2016.

“The fourth quarter RESI found that title agents continue to believe that property valuation issues will be the most likely cause of title order cancellation over the coming year.”

This shouldn’t come as a surprise. In a housing market where supply is very low and demand is very high, home values increase rapidly.

If prices are jumping in the Greenville Real Estate Market, it is difficult for appraisers to find adequate, comparable sales (similar houses in the neighborhood that closed recently) to defend the price when performing the appraisal for the bank.

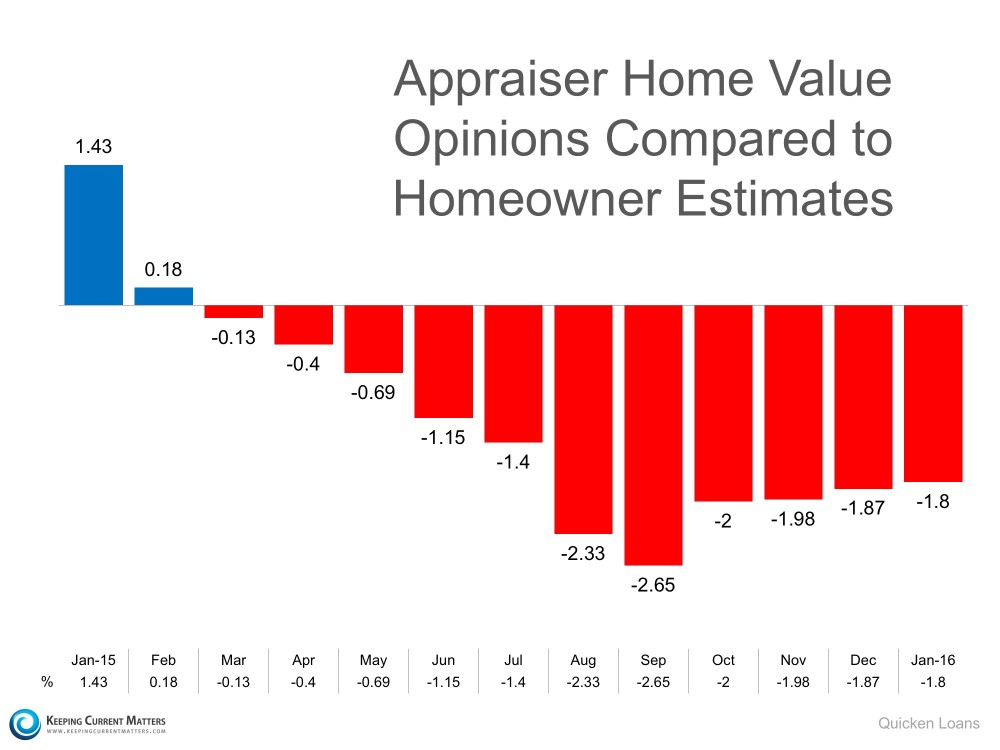

Another monthly report by Quicken Loans measures the disparity between what a homeowner believes their house is worth as compared to an appraiser’s evaluation.

Here is a chart showing that difference for each month through 2015.

Every house on the market in Upstate South Carolina has to be sold three times;

With escalating prices, the third sale might be the most difficult than the first two.

That is why we suggest that you use an experienced real estate team of professionals like The Carolina Success Team, who have an innovative approach to selling your home.

Their unique marketing program ensures you set your listing price right to achieve the highest price, in the lowest amount of time and with less hassles. Contact us today!

You are positioned to effectively challenge a low lender’s appraisal of your home, maintaining your higher contract price. A lender will consider a well-known appraisers valuation – they will not consider an estimate provided by a real estate agent.